At the end of every financial year most individuals seek options to minimise taxes. Here are few tax saving tips:

1. Avoid the last minute rush

Due to various reasons, many of us keep postponing our tax planning and do it in the last few months of the financial year. In this last minute rush, you might not choose the right tax saving scheme/investment.

In fact the right time to do the tax planning is the beginning of the financial year.

2. Salary Restructuring

Restructuring of salary (permitted in few Companies) includes restructuring of few components of the salary which could reduce your tax liability.

Perks and expenses such as medical allowance, transport allowance, education allowance, uniform expenses (if any), and telephone expenses can be included as part of the salary.

Bills of the actual expenses incurred for these allowances need to be submitted.

You can also opt for food coupons instead of lunch allowances.

3. House Rent Allowance (HRA)

If you reside in a rented house, you can claim HRA, which could be partially or completely exempt from taxes.

House rent expenses are deducted from the gross taxable income.

The deduction available is the minimum of the following amounts:

- Actual HRA received

- 50% of [Basic salary + DA] for those living in metro cities (40% for non-metros)

- Actual rent paid less 10% of salary

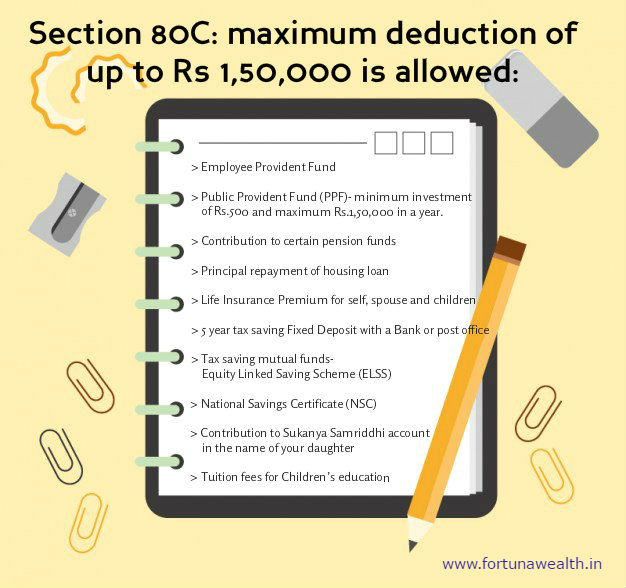

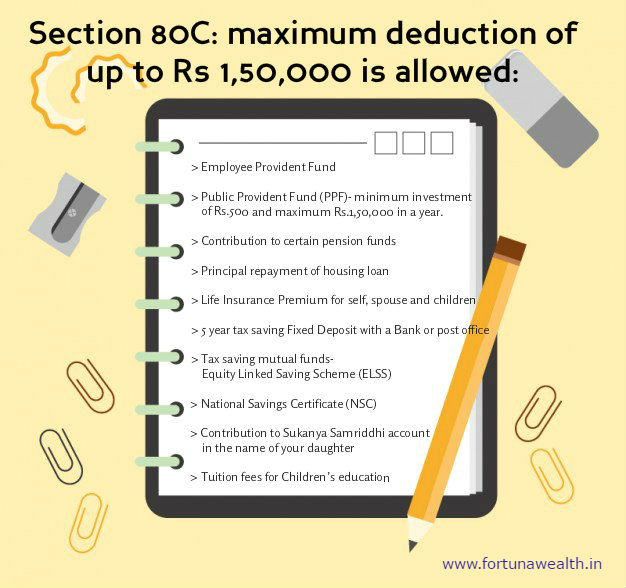

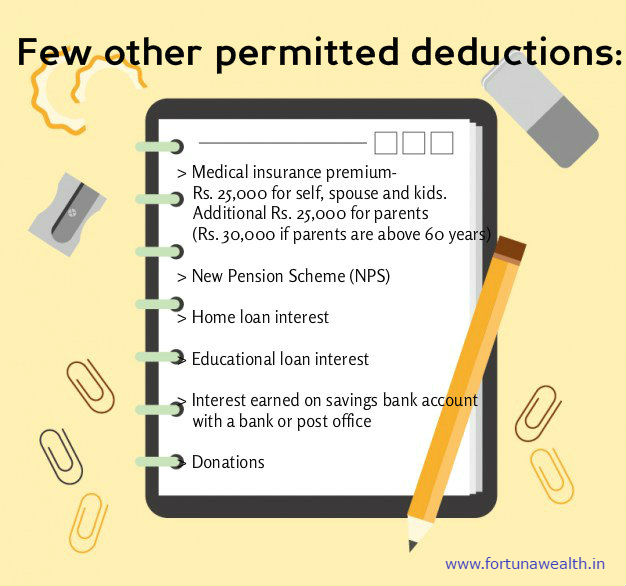

- Section 80C and other deductions

- Leave Travel Allowance (LTA) and Medical Expense

Tax exemption on LTA can be claimed when you apply for leave from your company for travel and have an actual journey.

Only the cost of travel for the trip is included in LTA. Hotel accommodation, food, etc. cannot be claimed for this exemption.

LTA exemption is limited to two times in a block of 4 years.

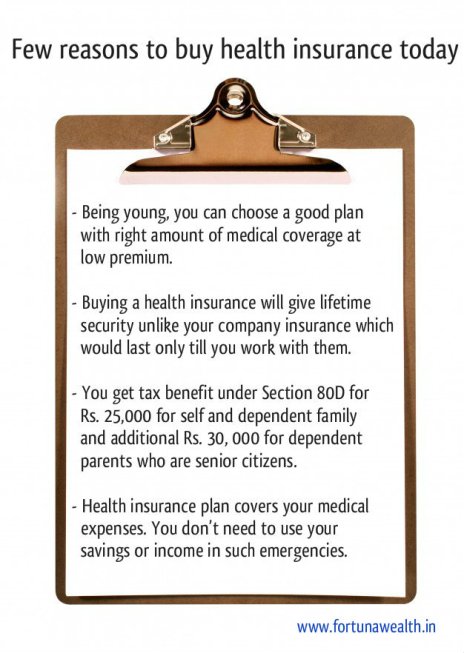

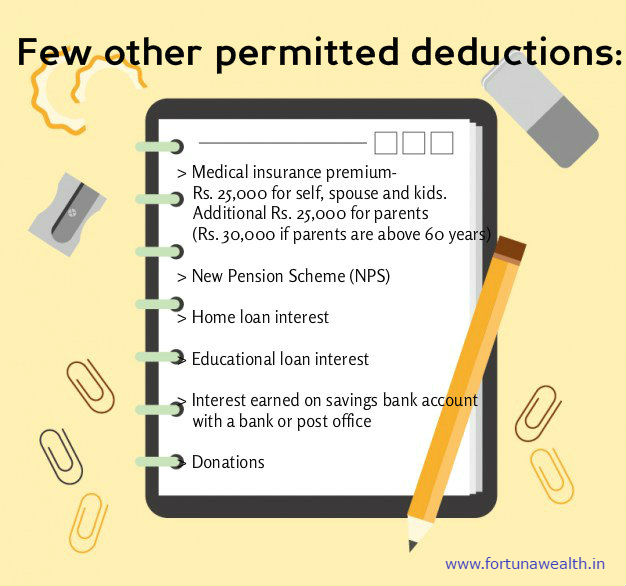

Other prominent exemption is medical expenses incurred by self and his/her family in a financial year.

This implies you do not have to pay tax on the amount of medical bills submitted in a financial year.

You can claim tax exemption only up to Rs.15,000 per year.

- Tax planning as per financial goals

Identifying your financial needs/goals is important.

Your financial goals could be your children’s higher education, buying a home, retirement planning or buying a car.

Tax investment planning can be done in a manner that aligns with your financial goals. This would mean your tax investments can provide tax relief as wells as help you to achieve your future financial requirements.

- Understanding future commitments in tax saving schemes

Before choosing a tax saving scheme, understand your future financial commitments.

Tax saving options like NSC and Mutual fund tax saving (ELSS) need only one time investment. However, PPF and life insurance require periodical investments year after year.

You need to check if you will be able to meet the future commitments at ease, if you need such a future commitment, if you can commit for periodical future payments, etc.

If there is a change in law, you may not get any tax exemption for your future payment. so, you need to consider if you want to buy the scheme irrespective of tax benefit for future.

- Income changes- Redo your tax plan

If you change your job or there are any changes in your income, you need to change your tax planning accordingly.

- On time tax declarations

One of the most vital tips for tax saving is timely tax declaration.

Employers need to pay advance tax every quarter. Therefore, they deduct TDS every month from your salary.

If the planned tax saving, investment and expenses of the year is not declared, the projected tax will be higher. The employer would deduct TDS according to this projection.

While filing your income tax return, you can claim a refund for these extra taxes paid. However, to avoid tax deduction, it is always better to submit a tax declaration to your employer at the beginning of the year.

For more information please visit http://www.fortunawealth.in